Presentation Transcripts

Latest Update : Dec.6, 2023

Back to Financial Results (FY3/2024)

Investor Meeting Presentation for 2Q FY 3/2024 held on November 2, 2023

- Cover

- Today's Agenda

- Financial Results

- Summary of Consolidated Business Results for 2Q

- Summary of Consolidated Business Results for 1H

- Net Sales, Operating Income / Margin

- 2Q Actual: Differences from the Forecast as of August

- Precision Technologies (PT)

- Motor, Lighting & Sensing (MLS)

- Semiconductors & Electronics (SE)

- Access Solutions (AS)

- Profit Attributable to Owners of the Parent / EPS

- Inventory

- Net Interest-bearing Debt / Free Cash Flow

- Forecast

- Forecast for Business Segment

- Full-year Operating Income: Differences from the Initial Forecast

- Management Policy & Business Strategy

- Summary

- Key Points of FY3/24 Forecast

- Business Acquisition of Hitachi Power Semiconductor Device, LTD.

- Expansion of the Power Semiconductor Business through the Acquisition of Hitachi Power Semiconductor Device Business (1)

- Expansion of the Power Semiconductor Business through the Acquisition of Hitachi Power Semiconductor Device Business (2)

- Access Solutions Segment (AS)

- FY3/25 Operating Income Image

- Signs of Bottoming Out

- ESG Topics (1)

- ESG Topics (2)

- Shareholders Return

- Forward-looking Statements

- Reference

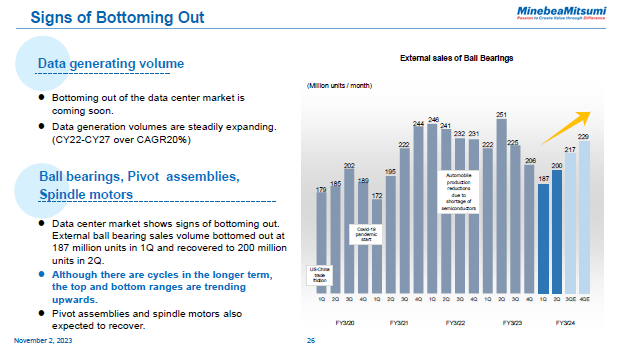

This may seem a little early, but we have told you that bearings are a leading indicator of the economy, which means that bearing orders fluctuate before anything else.

As this chart clearly shows, our external actual and tentative sales volume are as follows: 1Q 187 million units/month, 2Q 200 million units/month, 3Q 217 million units/month, and 4Q 229 million units. We believe that we have hit the bottom, if not bottomed out.

In fact, bearings for automobiles are at record highs, air conditioners are doing well, and office machines are recovering. What has not recovered is fan-related products, which at one point were 80 million units/month, but dropped to 35 million units/month in April. However, for January 2024, we received tentative orders of 60 million units/month, and we feel that the market inventory has begun to be reduced. We are hearing that similar trends are being seen in various industries and that logistics are also gradually recovering. Furthermore, in line with the inventory correction of hard disks, the number of helium drives is expected to increase gradually.

Once the inventory adjustment is completed, to what extent is the current real demand, and whether it is a gradual recovery or a V-shaped recovery will be determined. We need to keep an eye on the market a little more closely, but we believe it is more positive than before.

26page (total 39pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.