Presentation Transcripts

Latest Update : Dec.6, 2023

Back to Financial Results (FY3/2024)

Investor Meeting Presentation for 2Q FY 3/2024 held on November 2, 2023

- Cover

- Today's Agenda

- Financial Results

- Summary of Consolidated Business Results for 2Q

- Summary of Consolidated Business Results for 1H

- Net Sales, Operating Income / Margin

- 2Q Actual: Differences from the Forecast as of August

- Precision Technologies (PT)

- Motor, Lighting & Sensing (MLS)

- Semiconductors & Electronics (SE)

- Access Solutions (AS)

- Profit Attributable to Owners of the Parent / EPS

- Inventory

- Net Interest-bearing Debt / Free Cash Flow

- Forecast

- Forecast for Business Segment

- Full-year Operating Income: Differences from the Initial Forecast

- Management Policy & Business Strategy

- Summary

- Key Points of FY3/24 Forecast

- Business Acquisition of Hitachi Power Semiconductor Device, LTD.

- Expansion of the Power Semiconductor Business through the Acquisition of Hitachi Power Semiconductor Device Business (1)

- Expansion of the Power Semiconductor Business through the Acquisition of Hitachi Power Semiconductor Device Business (2)

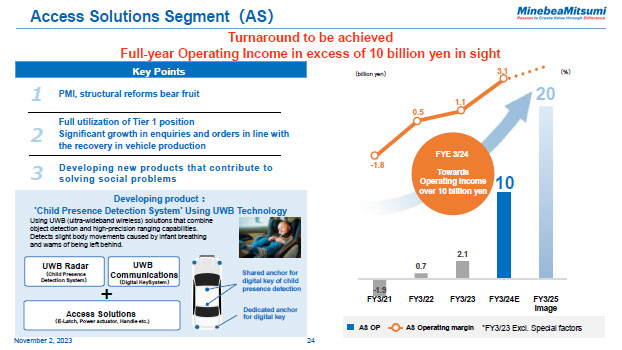

- Access Solutions Segment (AS)

- FY3/25 Operating Income Image

- Signs of Bottoming Out

- ESG Topics (1)

- ESG Topics (2)

- Shareholders Return

- Forward-looking Statements

- Reference

The second major news to share is that Access Products, which had been a cause of concern is expected to achieve an operating income level of over 10 billion yen this fiscal year, thanks to the recovery of automobiles and the various performance improvements we have been implementing.

This includes not only the profits of U-Shin and Minebea AccessSolutions (MAS, formerly Honda Lock), but also the profits of MITSUMI's automotive business, which has been reclassified into a new segment. We believe that the total of all three businesses will be enough to target 20 billion yen in the next fiscal year.

The 1Q was an operating loss of about 500 million yen, and the 2Q was an operating income of about 1.2 billion yen. There was a delay in the audit of a certificate concerning a price correction for a European customer to whom we raised prices during the past six months. We believe that the substantial operating income for the 2Q was approximately 2.1 billion yen.

In fact, we are expecting the same level of operating come in November and onward.

We have received a significant number of new orders and will continue to expand this business as planned.

For example, we are currently receiving orders that use our various elemental technologies and products, such as sensors and antennas in door handles, and we expect this to continue to expand. The world we have envisioned is coming to fruition, and we intend to move forward with the same strategy as before.

24page (total 39pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.