Financial Highlights

Latest Update : Dec.1, 2025

* MinebeaMitsumi has adopted International Financial Reporting Standards (IFRS) from the 1Q of FY3/2019.

- Annual

- Quarter

Financial Highlights

| FY3/2025

2Q | FY3/2025

3Q | FY3/2025

4Q | FY3/2026

1Q | FY3/2026

2Q |

||

|---|---|---|---|---|---|---|

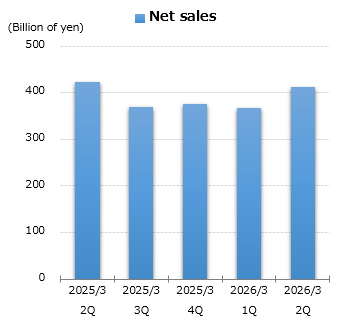

| Net sales | millions of yen | 422,783 | 369,643 | 374,823 | 366,925 | 411,389 |

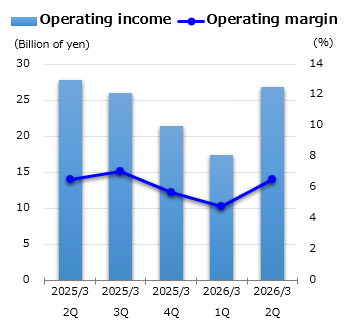

| Operating income | millions of yen | 27,887 | 26,163 | 21,531 | 17,432 | 26,955 |

| Operating margin | % | 6.6% | 7.1% | 5.7% | 4.8% | 6.6% |

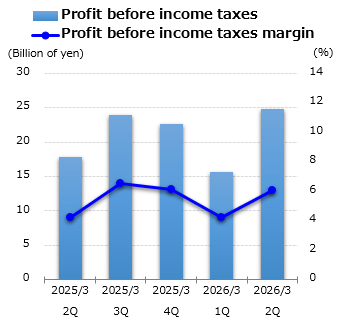

| Profit before income taxes | millions of yen | 17,771 | 23,923 | 22,682 | 15,589 | 24,781 |

| Profit before income taxes margin | % | 4.2% | 6.5% | 6.1% | 4.2% | 6.0% |

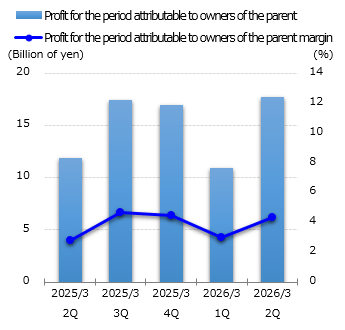

| Profit for the period attributable to owners of the parent | millions of yen | 11,925 | 17,418 | 16,966 | 10,889 | 17,696 |

| Profit for the period attributable to owners of the parent margin | % | 2.8% | 4.7% | 4.5% | 3.0% | 4.3% |

Per Share

| FY3/2025

2Q | FY3/2025

3Q | FY3/2025

4Q | FY3/2026

1Q | FY3/2026

2Q |

||

|---|---|---|---|---|---|---|

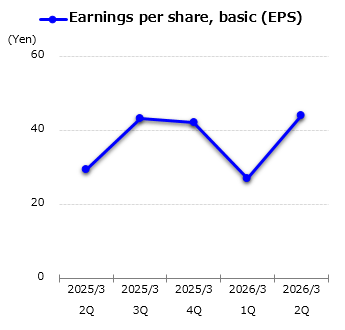

| Earnings per share, basic (EPS) | yen | 29.53 | 43.36 | 42.25 | 27.12 | 44.07 |

| Earnings per share, diluted | yen | 29.53 | 43.36 | 42.25 | 27.11 | 44.06 |

| Cash dividends per share | yen | 20.00 | - | 25.00 | - | 25.00 |

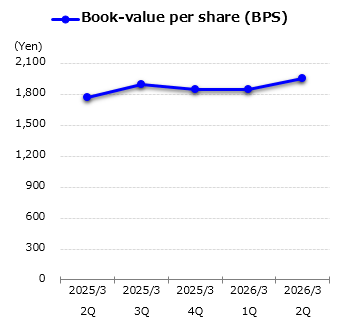

| Book-value per share (BPS) | yen | 1,770.33 | 1,899.79 | 1,851.29 | 1,845.65 | 1,952.43 |

| Total weighted average number of shares outstanding*1 | shares | 403,787,625 | 401,706,641 | 401,585,684 | 401,585,374 | 401,593,588 |

| Number of shares outstanding at the end of each period*1 | shares | 402,790,900 | 401,585,866 | 401,585,465 | 401,585,346 | 401,596,068 |

Performance Indicators

| FY3/2025

2Q | FY3/2025

3Q | FY3/2025

4Q | FY3/2026

1Q | FY3/2026

2Q |

||

|---|---|---|---|---|---|---|

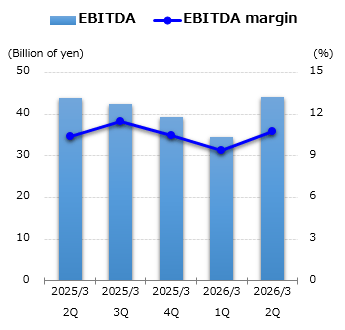

| EBITDA*2 | millions of yen | 43,924 | 42,527 | 39,225 | 34,511 | 44,193 |

| EBITDA margin*2 | % | 10.4% | 11.5% | 10.5% | 9.4% | 10.7% |

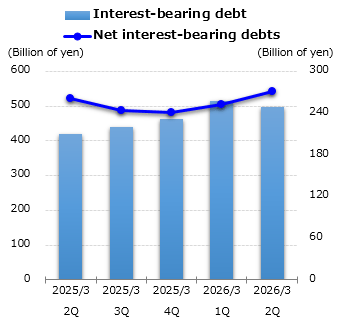

| Interest-bearing debt*3 | millions of yen | 419,052 | 441,358 | 463,597 | 515,489 | 498,454 |

| Net interest-bearing debts*3 | millions of yen | 260,482 | 244,460 | 241,449 | 252,685 | 271,017 |

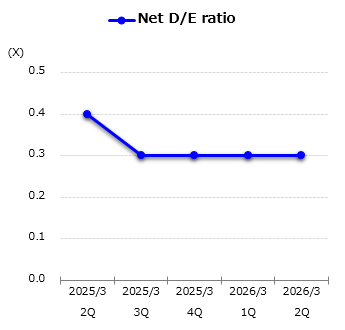

| Net D/E ratio*3 | X | 0.4 | 0.3 | 0.3 | 0.3 | 0.3 |

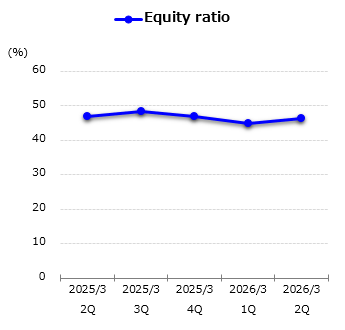

| Equity ratio | % | 46.9% | 48.4% | 46.9% | 45.0% | 46.3% |

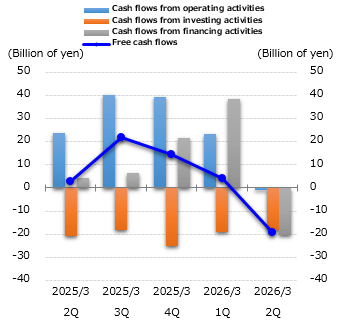

| Cash flows from operating activities | millions of yen | 23,707 | 40,312 | 39,450 | 23,293 | -951 |

| Cash flows from investing activities | millions of yen | -20,738 | -18,383 | -24,929 | -19,009 | -18,207 |

| Cash flows from financing activities | millions of yen | 4,392 | 6,637 | 21,463 | 38,554 | -20,162 |

| Free cash flows | millions of yen | 2,969 | 21,929 | 14,521 | 4,284 | -19,158 |

Expenditures etc

| FY3/2025

2Q | FY3/2025

3Q | FY3/2025

4Q | FY3/2026

1Q | FY3/2026

2Q |

||

|---|---|---|---|---|---|---|

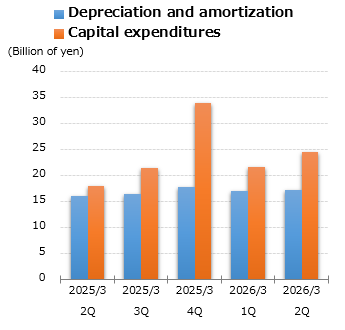

| Depreciation and amortization | millions of yen | 16,037 | 16,364 | 17,694 | 17,079 | 17,238 |

| Capital expenditures | millions of yen | 17,989 | 21,358 | 33,860 | 21,576 | 24,558 |

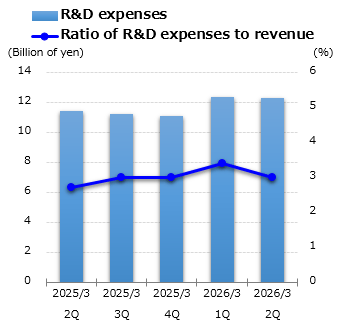

| R&D expenses | millions of yen | 11,461 | 11,259 | 11,103 | 12,343 | 12,327 |

| Ratio of R&D expenses to revenue | % | 2.7% | 3.0% | 3.0% | 3.4% | 3.0% |

- *1 Number of outstanding shares : Total number of shares issued - Treasury stock

- *2 EBITDA : Operating income + Depreciation and amortization

- *3 Net interest-bearing debts = "Bonds and borrowings" - ("Cash and cash equivalents" + Time deposit more than 3 months)