Presentation Transcripts

Latest Update : May 28, 2014

Back to Financial Results (FY3/2014)

Investor Meeting Presentation for FY 3/2014 held on May 9, 2014

- Cover

- Table of contents

- Financial Results

- Summary of Consolidated Business Results

- Summary of Consolidated Business Results for 4Q

- Net Sales

- Operating Income

- Machined Components Business 1

- Machined Components Business 2

- Electronic Devices & Components Business 1

- Electronic Devices & Components Business 2

- Net Income

- S.G. & A. Expenses

- Inventories

- Capital Expenditure & Depreciation

- Net Interest-Bearing Debt & Net D/E ratio

- FCF & Net Interest-Bearing Debt

- Forecast for Fiscal Year Ending March 31, 2015

- Forecast for Business Segment

- Policy and Strategy

- Forecast for Fiscal Year Ending March 31, 2015

- 10% operating margin is achieved !

- Minebea is entering into a new growth stage

- A new stage beyond global economic growth

- Demand growing for ultra-precision products

- Expected organic growth leads to sales of ¥500 billion !!

- Sell 150 mill. ball bearings externally / month

- Growth of miniature ball bearings for automobiles

- Aircraft components business grows

- Profile of NHBB/myonic BU (including CEROBEAR)

- Rapid sales growth of LED backlights

- Develop and boost sales of new EMS products

- My mission as CEO

- Strategy for 100th anniversary leads to ¥500+ bill. sales

- The Five Arrows : a risk-hedged strategy for 100th Anniversary

- Boost sales of lighting device-related products

- Take Measuring Components BU sales to 20 billion yen

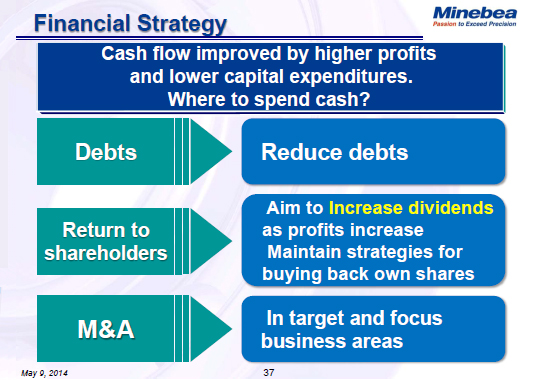

- Financial Strategy

- Improvement of balance sheet

- Dividend and buy-back policies

- M&A and alliance strategies

- Forward-looking Statements

Finally, let's look at our financial strategy. Although we used to pay an annual dividend of more than 10 yen per share in the past, for the fiscal year that ended March 2014 we will increase our dividend by one yen to make it an annual dividend of 8 yen upon approval at the general meeting of shareholders to be held in June.

If our performance exceeds our initial forecast, we will then look into a bigger dividend increase for this fiscal year. We set the dividend payout ratio target at 20%.

While we had been focusing on eliminating deficits and putting us on a growth track rather than increasing dividends, we have to look more carefully into how we can provide a higher return to our investors.

38page (total 42pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.