Presentation Transcripts

Latest Update : May 28, 2014

Back to Financial Results (FY3/2014)

Investor Meeting Presentation for FY 3/2014 held on May 9, 2014

- Cover

- Table of contents

- Financial Results

- Summary of Consolidated Business Results

- Summary of Consolidated Business Results for 4Q

- Net Sales

- Operating Income

- Machined Components Business 1

- Machined Components Business 2

- Electronic Devices & Components Business 1

- Electronic Devices & Components Business 2

- Net Income

- S.G. & A. Expenses

- Inventories

- Capital Expenditure & Depreciation

- Net Interest-Bearing Debt & Net D/E ratio

- FCF & Net Interest-Bearing Debt

- Forecast for Fiscal Year Ending March 31, 2015

- Forecast for Business Segment

- Policy and Strategy

- Forecast for Fiscal Year Ending March 31, 2015

- 10% operating margin is achieved !

- Minebea is entering into a new growth stage

- A new stage beyond global economic growth

- Demand growing for ultra-precision products

- Expected organic growth leads to sales of ¥500 billion !!

- Sell 150 mill. ball bearings externally / month

- Growth of miniature ball bearings for automobiles

- Aircraft components business grows

- Profile of NHBB/myonic BU (including CEROBEAR)

- Rapid sales growth of LED backlights

- Develop and boost sales of new EMS products

- My mission as CEO

- Strategy for 100th anniversary leads to ¥500+ bill. sales

- The Five Arrows : a risk-hedged strategy for 100th Anniversary

- Boost sales of lighting device-related products

- Take Measuring Components BU sales to 20 billion yen

- Financial Strategy

- Improvement of balance sheet

- Dividend and buy-back policies

- M&A and alliance strategies

- Forward-looking Statements

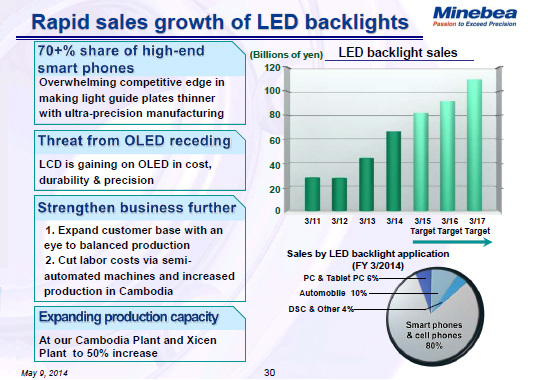

LED backlights will have the largest impact on our three-year plan.

The slide shows that our sales target for the fiscal year ending March 2015 is 80 billion yen. Given the current order status, it may easily exceed 100 billion yen.

The Chinese mobile phone market is now growing at a phenomenal rate. This year mobile phones with a 3-millimeter thick 5-inch screen are expected to be the standard in the Chinese market. LED backlights for these types of mobile phones are being made thinner and thinner, but right now no company can hold a candle to us. Viewing the current market waters, it looks like we'll have some smooth sailing ahead. In the Chinese mobile phone market LTE products are high end models and 3G models are the standard. The kind of thin models that would employ our ultra-thin LED backlights sold 200 million units there last year, and unit sales are expected to hit about 300 million this year. In fact, a third to a fourth of China's mobile phone demand will be for this kind of thin model. Looking at the volume of tentative orders we've gotten from Chinese manufacturers so far, our production volume should be double what it was last year. Meeting that demand is the big challenge now. We should be able to tell you whether we have overcome that hurdle at the upcoming first quarter investor meeting to be held in July, but for now our sales target is set at 80 billion yen.

As you can see from the slide, the threat from OLED (Organic light-emitting diode) is receding. There is no other manufacturer with a production capacity like ours who can supply LED backlights. Now that development of new models for the next year is already underway, we absolutely must respond to the explosive surge in demand this year and the next year.

31page (total 42pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.