Presentation Transcripts

Latest Update : May 28, 2014

Back to Financial Results (FY3/2014)

Investor Meeting Presentation for FY 3/2014 held on May 9, 2014

- Cover

- Table of contents

- Financial Results

- Summary of Consolidated Business Results

- Summary of Consolidated Business Results for 4Q

- Net Sales

- Operating Income

- Machined Components Business 1

- Machined Components Business 2

- Electronic Devices & Components Business 1

- Electronic Devices & Components Business 2

- Net Income

- S.G. & A. Expenses

- Inventories

- Capital Expenditure & Depreciation

- Net Interest-Bearing Debt & Net D/E ratio

- FCF & Net Interest-Bearing Debt

- Forecast for Fiscal Year Ending March 31, 2015

- Forecast for Business Segment

- Policy and Strategy

- Forecast for Fiscal Year Ending March 31, 2015

- 10% operating margin is achieved !

- Minebea is entering into a new growth stage

- A new stage beyond global economic growth

- Demand growing for ultra-precision products

- Expected organic growth leads to sales of ¥500 billion !!

- Sell 150 mill. ball bearings externally / month

- Growth of miniature ball bearings for automobiles

- Aircraft components business grows

- Profile of NHBB/myonic BU (including CEROBEAR)

- Rapid sales growth of LED backlights

- Develop and boost sales of new EMS products

- My mission as CEO

- Strategy for 100th anniversary leads to ¥500+ bill. sales

- The Five Arrows : a risk-hedged strategy for 100th Anniversary

- Boost sales of lighting device-related products

- Take Measuring Components BU sales to 20 billion yen

- Financial Strategy

- Improvement of balance sheet

- Dividend and buy-back policies

- M&A and alliance strategies

- Forward-looking Statements

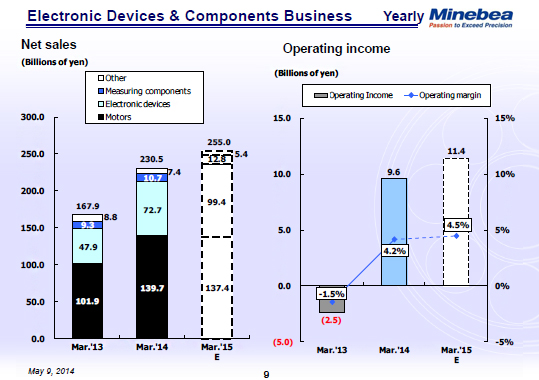

In the electronic devices and components business segment, net sales for the fiscal year ended March 31, 2014 totaled 230.5 billion yen. That's up 37.3% from the previous fiscal year due to strong growth in LED backlight sales, which account for the majority of electric devices sold, and represents a turnaround for the motor business after restructuring. Operating income improved significantly to reach 9.6 billion yen, with the operating margin up 5.7 percentage points over the previous year at 4.2%.

Sales of motors rose 37.1% over the previous year to total 139.7 billion yen. The motor business continued to earn steady profits after the second quarter due to the global economic recovery and restructuring measures.

For the fiscal year ending March 2015, we expect to see lower sales due to the restructuring of Moatech but higher profits from motor products in general.

Net sales of electronic devices soared 51.8% over what they were the previous year to total 72.7 billion yen. LED backlight shipment volumes increased significantly due to large orders for smart phones and an expanded customer base, made up mostly of Chinese smart phone manufactures. Both sales and profits of LED backlights increased. We have sharpened our competitive edge with thinner LED backlights that offer higher definition and as a result demand has been soaring. For the fiscal year ending March 2015, we expect another jump in sales and profits as we expand production capacity in China and Cambodia, in addition to our existing production operations in Thailand.

Net sales of measuring components rose 15.1% over the previous fiscal year to reach 10.7 billion yen due to increased demand for seat sensors in the North American automobile market. While profits remained steady, we expect even higher sales and profits for the fiscal year ending March 2015 due to increased production of automobile parts, etc.

10page (total 42pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.