Presentation Transcripts

Latest Update : Nov.26, 2014

Back to Financial Results (FY3/2015)

Investor Meeting Presentation for 2Q FY 3/2015 held on November 5, 2014

- Cover

- Table of Contents

- Financial Results

- Summary of Consolidated Business Results for 1H

- Summary of Consolidated Business Results for 2Q

- Net Sales

- Operating Income

- Machined Components Business

- Electronic Devices & Components Business

- Net Income

- S.G. & A. Expenses

- Inventories

- Capital Expenditure & Depreciation

- Net Interest-Bearing Debt

- Forecast for Fiscal Year Ending March 31, 2015

- Forecast for Business Segment

- Policy and Strategy

- Forecast for Fiscal Year Ending March 31, 2015

- Delivering mid-term OP target in 1st year!

- The two-pillar structure is completed!!

- Machined components: Continues to grow steadily

- LED backlights: Driving substantial growth

- Investments for next year's LED backlight production

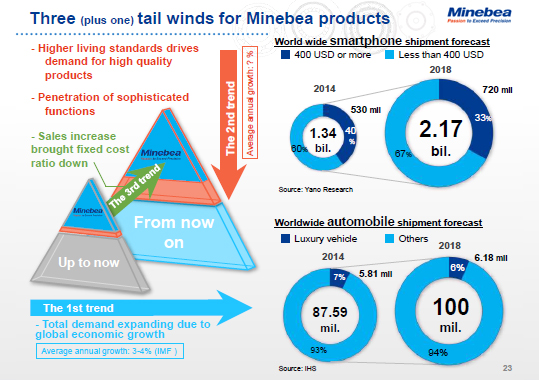

- Three (plus one) tail winds for Minebea products (1)

- Three (plus one) tail winds for Minebea products (2)

- Motor business: Profitability steadily improves

- Other electronic devices & components

- Launched joint ball bearing venture

- Boosting sales of lighting device-related products

- Progress with Five Arrows strategy ahead of 100th Anniversary

- Increased capital expenditure plan

- Increased dividend!

- M&A and alliance strategies

- Forward-looking Statements

(Continued from previous page)

However, the end of monetary easing by the US resulted in the weakening of Asian currencies. The yen weakened further with the recent surprise, and the deficits posted by overseas subsidiaries all became profits, ensuring the effect of the weak yen was positive this time. I am not sure if this could be called the fourth wind, so I have called it "Plus one" here, but in this way, the external environment has also developed favorably for us.

Looking at the market environment going forward, the market for high-end smartphones valued at 400 dollars or more is expected to expand from 530 million units this year to 720 million units in 2018. However, there are now slim models available for less than 400 dollars. High-end products are increasing here, but an even greater factor is that high performance components used in high-end products - such as our thin LED backlights - are spreading to mid-range products. We also believe that the OLED format that is the rival technology to the LCD format that requires LED backlights probably won't gain the upper hand for at least another five years. Meanwhile, our strength of making components thinner is becoming more technically difficult, and some have suggested that our rivals will catch up if we are unable to make components thinner, but that is not the case. The same applies to ball bearings, and if asked to make ball bearings of a certain precision, any leading ball bearing manufacturer is able to make small ball bearings. However, Minebea is the only one able to make them (1) with this quality, (2) in this large quantity, (3) at this price and (4) by this delivery date. The LED backlight business is exactly the same now. We are focusing on this and working to quickly recover our depreciation over two years, and aim to establish a model like the ball bearing business model through active investment.

25page (total 34pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.