Presentation Transcripts

Latest Update : Nov.26, 2014

Back to Financial Results (FY3/2015)

Investor Meeting Presentation for 2Q FY 3/2015 held on November 5, 2014

- Cover

- Table of Contents

- Financial Results

- Summary of Consolidated Business Results for 1H

- Summary of Consolidated Business Results for 2Q

- Net Sales

- Operating Income

- Machined Components Business

- Electronic Devices & Components Business

- Net Income

- S.G. & A. Expenses

- Inventories

- Capital Expenditure & Depreciation

- Net Interest-Bearing Debt

- Forecast for Fiscal Year Ending March 31, 2015

- Forecast for Business Segment

- Policy and Strategy

- Forecast for Fiscal Year Ending March 31, 2015

- Delivering mid-term OP target in 1st year!

- The two-pillar structure is completed!!

- Machined components: Continues to grow steadily

- LED backlights: Driving substantial growth

- Investments for next year's LED backlight production

- Three (plus one) tail winds for Minebea products (1)

- Three (plus one) tail winds for Minebea products (2)

- Motor business: Profitability steadily improves

- Other electronic devices & components

- Launched joint ball bearing venture

- Boosting sales of lighting device-related products

- Progress with Five Arrows strategy ahead of 100th Anniversary

- Increased capital expenditure plan

- Increased dividend!

- M&A and alliance strategies

- Forward-looking Statements

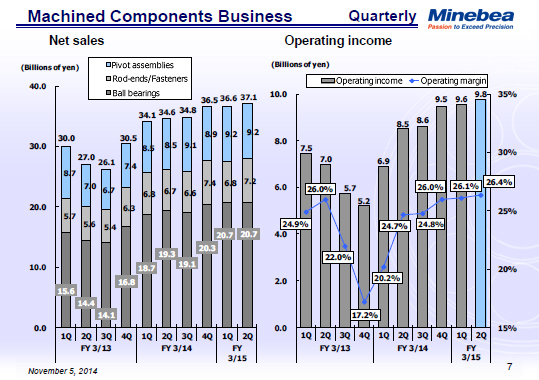

Second quarter net sales for the Machined Components business segment rose 1.3% from the previous quarter to total 37.1 billion yen. Operating income was up 2.3% from the previous quarter to reach 9.8 billion yen. The operating margin rose 0.3 percentage points to hit 26.4%. Robust demand continued to grow for all businesses in the segment, fueling a 7.2% increase in net sales and a 14.5% increase in operating income over the same period last year.

Sales of ball bearings were flat from the previous quarter at 20.7 billion yen. Demand swelled year on year to buoy external shipment volumes which hit another record high of 151 million units in September. We expect the external shipment volume to be high in the December quarter as well.

Sales and profits of rod-ends and fasteners increased 5.9% from the previous quarter to total 7.2 billion yen. Although the U.S. government's defense budget cuts put a dent in the demand, our shipments were up due to the growing demand from the civil aviation industry. Profitability also improved.

Sales of HDD pivot assemblies were flat from the previous quarter at 9.2 billion yen. We were able to earn steady profits due to our high market share in a stable HDD market.

8page (total 34pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.