Presentation Transcripts

Latest Update : Nov.26, 2014

Back to Financial Results (FY3/2015)

Investor Meeting Presentation for 2Q FY 3/2015 held on November 5, 2014

- Cover

- Table of Contents

- Financial Results

- Summary of Consolidated Business Results for 1H

- Summary of Consolidated Business Results for 2Q

- Net Sales

- Operating Income

- Machined Components Business

- Electronic Devices & Components Business

- Net Income

- S.G. & A. Expenses

- Inventories

- Capital Expenditure & Depreciation

- Net Interest-Bearing Debt

- Forecast for Fiscal Year Ending March 31, 2015

- Forecast for Business Segment

- Policy and Strategy

- Forecast for Fiscal Year Ending March 31, 2015

- Delivering mid-term OP target in 1st year!

- The two-pillar structure is completed!!

- Machined components: Continues to grow steadily

- LED backlights: Driving substantial growth

- Investments for next year's LED backlight production

- Three (plus one) tail winds for Minebea products (1)

- Three (plus one) tail winds for Minebea products (2)

- Motor business: Profitability steadily improves

- Other electronic devices & components

- Launched joint ball bearing venture

- Boosting sales of lighting device-related products

- Progress with Five Arrows strategy ahead of 100th Anniversary

- Increased capital expenditure plan

- Increased dividend!

- M&A and alliance strategies

- Forward-looking Statements

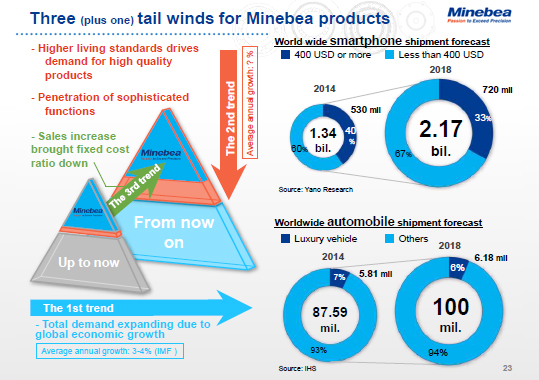

It says there are three (plus one) tail winds for Minebea products, and the first wind is the fact that the global economy has grown steadily and that there has been a steady expansion of wealth since the Lehman crisis. The second wind is the increase in demand for higher quality and greater functionality driven by rising living standards, and this has been a tail wind for component manufacturers like us who make high precision components. For example, it is believed that the number of automobiles produced will increase from 87.59 million in 2014 to over 100 million in 2018. The number of luxury cars produced will only increase from 5.81 million to 6.18 million, which is a comparatively small growth rate. However, the accessories in luxury cars have been quickly trickling down to mid-range and lower cars thanks to this second wind. The most easily understandable example from recent times is the electric parking brake. A parking brake was used by pulling a side brake lever after stopping the car, but now this is activated using an electric motor. It must always work and never loosen even in the coldest or hottest temperatures, and our ball bearings are contained within. Put differently, the second wind is that the area of the top triangle is expanding downwards.

The third wind is that as sales increase, fixed expenses in each business including my pay are more dispersed, and the SG&A expenses-to-sales ratio has been lowered by 6 points from the 17% to 18% level of several years ago to 12% now. This is not simply Minebea as a whole being more competitive, but more a matter each business being made significantly more competitive due to the expansion of sales.

There is actually an additional plus, which is the foreign exchange situation. Just last week, the Bank of Japan happened to move ahead with surprise monetary easing, and we have become more easily affected by the resulting depreciation of the yen than in the past. When the yen depreciated significantly with the emergence of Abenomics in 2012, US monetary easing had continued for a long time, and Asian currencies that affect our manufacturing costs were still high. Because of this, the effect of the weak yen was not properly reflected in our business.

(Continued on next page)

24page (total 34pages)

![]() You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

You need Adobe Reader® to view these documents. Click on Adobe Reader icon on the left to download the software from the Adobe Systems website.

It ends about main text.