2013

June 27, 2013

Minebea Co., Ltd.

Issuance of Stock Options (Stock Acquisition Rights) for Directors Compensation

Minebea Co., Ltd. (hereafter the "Company" or "Minebea") today announced that the Board of Directors of the Company held on June 27, 2013 has resolved to issue stock options for Directors (excluding outside directors) Compensation, in accordance with Articles 236, 238 and 240 of the Companies Act. The details of the resolution are described below.

I. The reason for issuing stock options for Directors Compensation

In line with the review of the director's remuneration system, the Company decided a partial revision of the system of remuneration (issuing stock options for Directors Compensation), for the purpose of making the link between the Company's business performance and stock value clearer in the director's remuneration system, giving them greater motivation to make contributions to improve business performance and increase enterprise value in the medium and long run, and facilitating their sense of sharing value with shareholders.

II. Terms and conditions of stock acquisition rights (stock options) issued for Directors Compensation

1. Name of stock acquisition rights

2nd Stock Acquisition Rights Issued by Minebea Co., Ltd. in 2013.

2. Qualification and total number of allottees of stock acquisition rights and total number of stock acquisition rights to be allotted

Directors (excluding outside directors): 7 people, 420 rights

The above number is the total number of stock acquisition rights that are expected to be allotted. In the event that such total number decreases if any allottee does not subscribe or otherwise, the total number of stock acquisition rights to be issued shall be equal to the total number of the stock acquisition rights that are actually allotted.

3. Class and number of shares to be issued upon exercise of stock acquisition rights

The class of shares to be issued upon exercise of stock acquisition rights will be common shares of the Company. The number of shares to be issued upon exercise of each of the 420 stock acquisition rights will be 100 shares (hereafter the "Number of Allotted Shares"). Thus the total number of shares to be issued upon exercise of stock acquisition rights will be 42,000.

In case the Company conducts a share split or a consolidation of shares, after the date of the allocation of stock acquisition rights (hereafter the "Day of Allotment"), the Number of Allotted Shares will be adjusted according to the formula below.

Number of Allotted Shares after adjustment = Number of Allotted Shares before adjustment × Ratio of share split or consolidation of shares

The Number of Allotted Shares after adjustment shall apply from the next day of the record date of the share split in case of a share split (if the record date is not set, from the effective date), and from the effective date of the consolidation of shares in case of a consolidation of shares.

In addition, in the case that the Company is subject to a merger, a company split, a share exchange or an allotment of shares without contribution after the Day of Allotment, or if there is another instance in which the adjustment of the Number of Allotted Shares is appropriate, the Company shall appropriately adjust it to a necessary and reasonable extent.

Any fractional shares resulting from the adjustment mentioned above shall be rounded off.

4. Amount of assets to be contributed upon the exercise of stock acquisition rights

The investment for each stock acquisition right shall be made in the form of cash and the amount of assets to be contributed upon the exercise of each stock acquisition right shall be determined by multiplying the per-share value by the Number of Allotted Shares, where the value per share to be received by the exercise of each stock acquisition right shall be ¥1.

5. Exercise period for stock acquisition rights

From the next Day of Allotment to July 15, 2043.

6. Matters concerning the amount of capital and capital reserve to be increased in the event that the Company issues shares upon exercise of stock acquisition rights

- (1) The amount of capital to be increased in the event that the Company issues shares upon exercise of stock acquisition rights shall be one-half of the amount of the maximum limit on the increase in capital as calculated in accordance with Article 17, Paragraph 1 of the Ordinance on Accounting of Companies. Any fraction of less than one yen resulting from the calculation mentioned above shall be rounded up to the nearest yen.

- (2) The amount of capital reserve to be increased in the event that the Company issues shares upon exercise of stock acquisition rights shall be obtained by deducting the amount of capital to be increased as set forth in (1) above from the amount of the maximum limit on the increase in capital provided in (1) above.

7. Restrictions on transfer of stock acquisition rights

Any proposed transfer of stock acquisition rights shall be subject to an approval of the Board of Directors of the Company.

8. Conditions for acquisition of stock acquisition rights

In the event that the following proposals are approved by a resolution of the General Meeting of Shareholders (or by a resolution of the Board of Directors of the Company when such resolution of the General Meeting of Shareholders is not required), the Company may acquire any stock acquisition rights without consideration on a date to be separately determined by the Board of Directors of the Company.

- (1) Proposal for the approval of a merger agreement under which the Company will be an absorbed company

- (2) Proposal for the approval of a demerger agreement or a demerger plan under which the Company will be a transferor

- (3) Proposal for the approval of a share exchange agreement or a share transfer plan under which the Company will be a wholly owned subsidiary company

- (4) Proposal for the approval of acquisition of all of the class shares subject to wholly call in accordance with Article 171, Paragraph 1 of the Companies Act

- (5) Proposal for the approval of an amendment to the articles of incorporation to establish new provisions by which any proposed transfer of shares to be issued by the Company shall be subject to the approval of the Company

- (6) Proposal for the approval of amendments to the articles of incorporation to establish new provisions by which any proposed transfer of any class shares to be issued upon exercise of stock acquisition rights shall be subject to the approval of the Company or by which the Company may acquire all of the class shares to be issued upon exercise of stock acquisition rights by the General Meeting of Shareholders

9. Matters regarding allotment of stock acquisition rights in the event of organizational restructuring

In the event that the Company effects a merger (limited to cases where the Company will be the absorbed company), a demerger by transfer to an existing company or a demerger by transfer to a newly established company (limited to cases where the Company will be the divisively reorganizing company in each case), or a share exchange or a share transfer (limited to cases where the Company will be the wholly owned subsidiary company in each case) (collectively, hereafter the "Organizational Restructuring"), in each case, the stock acquisition rights of the companies listed in Article 236, Paragraph 1, item 8(a) to 8(e) of the Companies Act, (hereafter the "Reorganized Company") shall be allotted to the each person who holds stock acquisition rights that are outstanding on the date immediately preceding the effective date of the Organizational Restructuring (which shall be, for an absorption-type merger, the effective date of the absorption-type merger; for an consolidation-type merger, the incorporation date of the newly formed stock company; for a demerger by transfer to an existing company, the effective date of the demerger takes effect ; for a demerger by transfer to a newly established company, the incorporation date of the newly established company; for a share exchange, the effective date of the share exchange; and for a share transfer, the incorporation date of the wholly owning parent company. The same shall apply hereafter.) (hereafter the "Outstanding Stock Acquisition Rights"); provided, however, the provision above shall apply only in cases where the allotment of stock acquisition rights of the Reorganized Company under the following terms and conditions is set forth in the relevant absorption-type merger agreement, incorporation-type merger agreement, demerger agreement, demerger plan share exchange agreement or share transfer plan:

- (1) Number of stock acquisition rights to be allotted by the Reorganized Company

The same number of stock acquisition rights as the number of Outstanding Stock Acquisition Rights held by the each holder shall be allotted. - (2) Class of shares of the Reorganized Company to be issued upon exercise of stock acquisition rights

Common shares of the Reorganized Company. - (3) Number of shares of the Reorganized Company to be issued upon exercise of stock acquisition rights

To be determined in accordance with 3. above, upon taking into consideration the conditions for Organizational Restructuring. - (4) Amount of assets to be contributed upon exercise of stock acquisition rights

The investment for each stock acquisition right shall be made in the form of cash and the amount of assets to be contributed upon exercise of each stock acquisition right shall be determined by multiplying the per-share value by the number of shares of the Reorganized Company to be issued upon exercise of the relevant stock acquisition rights determined in accordance with (3) above, where the value per share to be received by the exercise of each stock acquisition right of the Reorganized Company shall be ¥1. - (5) Exercise period for stock acquisition rights

The exercise period for stock acquisition rights shall be from the later of (a) the commencement date of the exercise period for stock acquisition rights stipulated in 5. above or (b) the effective date of the Organizational Restructuring, up to the expiration date of the exercise period for stock acquisition rights as stipulated in 5. above. - (6) Matters concerning the amount of capital and capital reserve to be increased in the event that the Company issues shares upon exercise of stock acquisition rights

To be determined in accordance with 6. above. - (7) Restrictions on transfer of stock acquisition rights

Any proposed transfer of stock acquisition rights shall be subject to the approval of the Board of Directors of the Reorganized Company. - (8) Conditions for acquisition of stock acquisition rights

To be determined in accordance with 8. above. - (9) Other conditions for exercise of stock acquisition rights

To be determined in accordance with 11. below.

10. Treatment of fractional shares resulting from the exercise of stock acquisition rights

Any fractional shares resulting from the exercise of stock acquisition rights shall be rounded off.

11. Other conditions for exercise of stock acquisition rights

- (1) A person who has been granted stock acquisition rights, but who ceases to be a director before the expiration of the exercise period in 5. above, may exercise all such rights, in a single transaction, within ten days (in the event that the 10th day is a holiday, by the next business day) of the day immediately following the day upon which he/she ceases to be a director.

- (2) In the event that a person who has been granted stock acquisition rights dies, only one heir to him/her (hereafter the "Successor") shall be entitled to succeed to his/her rights. Regardless of (1) above, the Successor may exercise all such rights, in a single transaction, within six months of the day immediately following the day upon which the person who has been granted stock acquisition rights dies. In the event that the Successor dies, no one shall be entitled to succeed to his/her rights.

- (3) Partial exercise of each stock acquisition rights shall be prohibited.

- (4) A person who has been granted stock acquisition rights may not exercise any of the stock acquisition rights that he/she has abandoned.

12. Calculation method for the amount to be paid in for stock acquisition rights

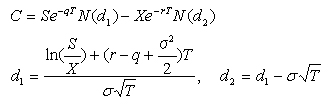

The amount to be paid in for each stock acquisition right shall be determined by multiplying the option price per share that is calculated based on the following formula, which is the Black-Scholes model, and the basic figures below, by the Number of Allotted Shares (Any fraction of less than one yen shall be round up to the nearest yen).

| (1) Option price per share (C) | ||

|---|---|---|

| (2) Stock price (S) | : | The closing price per share of the Company on July 16, 2013 at the Tokyo Stock Exchange (if no price is available on such day, then the standard price on the trading day immediately preceding July 16, 2013) |

| (3) Exercise price (X) | : | 1 yen |

| (4) Period between the Day of Allotment and the maturity date (T) | : | 4.6 years |

| (5) Volatility (σ) | : | The rate of stock price variability is calculated based on the closing price at the Tokyo Stock Exchange on each trading day in the preceding 4.6 year (from December 9, 2008 to July 16, 2013) |

| (6) Risk-free interest rate (r) | : | The interest rate on Japanese government bonds for which the remaining years are almost equal to the expected remaining period |

| (7) Dividend yields (q) | : | (Actual dividend paid in the fiscal year ended March 31, 2013) ÷ (stock price as specified in (2) above) |

| (8) Cumulative distribution function of the standard normal distribution (N(-)) | ||

The amount calculated above is a fair value of stock acquisition rights and is not classified as favorable issuance. The person who has been allotted stock acquisition rights shall set off his/ her claims for remuneration against the Company in lieu of payment of monies for the stock acquisition rights allotted in accordance with Article 246, Paragraph 2 of the Companies Act.

13. Day of allotment of stock acquisition rights

July 16, 2013

14. Stock acquisition rights certificates

The Company shall not issue any stock acquisition rights certificates.

| Company Name: | Minebea Co., Ltd. |

| Representative: | Yoshihisa Kainuma Representative Director, President and Chief Executive Officer (Code No. 6479, TSE Div. No.1) |

| Contact: | Naoyuki Kimura General Manager Personnel Department |

| Tel: | +81-(0)3-6758-6712 |

Product information, contact and other context are subject to change without prior notice.