CFO Message

Latest Update : Sept.29, 2023

By the fiscal year ending March 2029, we aim to achieve net sales and operating income of 2.5 trillion yen and 250 billion yen, respectively. Meanwhile, we have set an ROE of 15% or more and EPS growth rate of 15% or more (10-year CAGR) as our target KPIs in alignment with achieving such growth. To achieve our long-term target and Midterm Business Plan, as the person in charge of such matters, I will steadily implement the financial strategy and capital policy.

We greatly improve our ability to generate cash by establishing various forms of financial discipline and rigorously strengthening our financial position. Additionally, I will strengthen the financial base by appropriately managing the cash generated by clearly setting a cash allocation policy, and implement returns to shareholders which will satisfy investors.

Furthermore, in considering our medium- to long-term portfolio, I will identify appropriate businesses in which to invest, depending on profitability, with a focus on the cost of capital, such as ROIC. I will aim to maximize investment efficiency and optimize allocation of management resources in order to increase corporate value.

Financial strategy and capital policy

Capital efficiency and EPS growth rate

On profitability, we have set ROE of 15% or more and EPS growth rate of 15% or more (10-year CAGR) as our target KPIs. Having made "strengthening our financial position" a basic policy, the MinebeaMitsumi Group has taken various steps that include engaging in efficient capital expenditure, managing assets, and reducing interest-bearing debt.

The Company's ROE for the fiscal year ended March 2023 was 13.1%, thereby nearing the 15% threshold. Meanwhile, ROIC stood at 9.5%, thereby surpassing the hurdle rate of 8%.

Moreover, EPS for the fiscal year ended March 2023 was 187.62 yen. In the fiscal year ending March 2029, we are poised to achieve the operating income of 250 billion yen and the EPS growth rate of 15% CAGR.

At the same time, we are achieving both organic growth and growth driven by the global M&A carried out by leveraging our superior ability to generate cash. In addition, we will focus on capturing new business opportunities, such as the development of products which contribute to resolving social issues.

In so doing, we will enhance profitability and growth potential, maximize our ability to generate cash, and further strengthen our financial position.

Cash-generating ability

In the fiscal year ended March 2023, the Company achieved record-high results with net sales of 1.2922 trillion yen and operating income of 101.5 billion yen. Meanwhile, EBITDA has also been on the rise thanks to our having undertaken capital expenditure based on prudent assessment of recoverability. Back in the fiscal year ended March 2010, we achieved growth of 13% (CAGR). We project that net interest-bearing debt will amount to 170.0 billion yen in the fiscal year ending March 2024. The Company's ability to generate cash has steadily improved, allowing us to expand our business while maintaining net interest-bearing debt at appropriate levels.

Cash allocation and security of the financial base

Cash allocation

50% of generated operating cash flows are to be allocated to capital expenditure to act as a driver of organic growth. Of the remaining 50%, while half will be allocated to appropriate and flexible shareholder returns, we are proactively considering options to carry out effective M&As enlisting the other half, together with borrowings, premised on the notion of maintaining financial discipline such that the net debt equity ratio falls within the 0.2 times range.

Capital expenditures and shareholder returns

Underpinned by such medium- to long-term policy, capital expenditure amounted to 147 billion yen in the fiscal year ended March 2023, which includes one-time investment in relocation to the Tokyo X Tech Garden. During the fiscal year ending March 2024, our plans call for capital expenditure of 73 billion yen, primarily for investments in semiconductor-related facilities.

In addition, regarding the annual dividend, having undertaken a comprehensive review of the business environment, MinebeaMitsumi aims to continue to pay out stable dividends, targeting a dividend payout ratio of around 20% on a consolidated basis, in principle, in order to enhance returns to its shareholders.

In the fiscal year ended March 2023, annual dividends per share amounted to 40 yen, an increase of 4 yen over the 36 yen for the previous fiscal year. In February 2023, the Company announced and carried out share buybacks of 10 billion yen.

As for shareholder returns going forward, the Company will provide dividends and carry out share buybacks under similar policy.

Security of the financial base

It is our belief that accelerating the pace of business expansion whilst simultaneously ensuring stability of our financial base is of the utmost importance. We have received very favorable credit ratings from two credit rating agencies, having been assigned an "A+" rating from Japan Credit Rating Agency, Ltd. (JCR) and an "A+" rating from Rating and Investment Information, Inc. (R&I) in November 2022.

Although our equity ratio may vary in the short term depending on status of M&A implementation, we aim to achieve a stable financial base by accordingly maintaining an equity ratio of at least 50% over the medium to long term.

Midterm Business Plan toward further growth

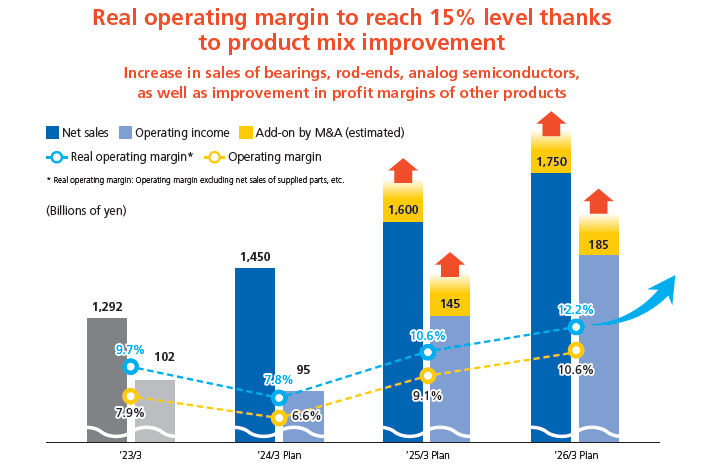

In May 2023, the Company released its new Midterm Business Plan, which serves as a concrete roadmap for achieving further growth in pursuit of its long-term targets for the fiscal year ending March 2029. In the Midterm Business Plan, our targets for the fiscal year ending March 2026, are set at net sales of 1.75 trillion yen and operating income of 185 billion yen. We have accordingly established a platform for our Eight Spear products to achieve growth at a pace surpassing that of past years, drawing on a lineup of global niche top products that generate high profitability centered around bearings, rod-ends, motors, analog semiconductors, access products, and INTEGRATION products.

We have also established a target of achieving real operating margin (operating margin excluding net sales of supplied parts, etc.) in the 15% range by improving our product mix. We have concluded four M&A deals for the fiscal year ended March 2023. Given our accumulated PMI expertise and solid financial base, we are in a favorable position to swiftly achieve the objectives of the Midterm Business Plan.

We will attain certain growth toward achieving our long-term targets by forging ahead in developing products that contribute to resolving social issues, while also pursuing organic growth and M&As.

Initiatives for improving profitability

The Company's efforts to enhance profitability entail rigorously cutting costs in part by lowering the materials cost ratio and the factory overhead ratio. We are also focusing on transforming fixed costs into variable costs, thereby increasing profitability through greater flexibility in cost management.

Furthermore, although we have carried out numerous M&As including large-scale M&As over the last several years, the Company's S.G.&A. expense ratio has remained in the 11% range, which reveals plenty of room for improvement. Labor costs account for approximately half of our S.G.&A. expenses, followed by logistics costs and outsourcing expenses. Given that we regard this as one of our key management issues, we will move forward with projects enlisting a 2% S.G.&A. expense ratio reduction target, which is to be achieved in part by increasing white collar productivity and improving transport efficiency.

Management for value creation

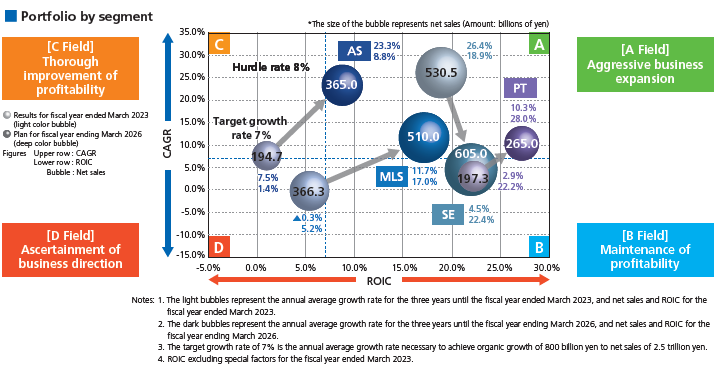

The MinebeaMitsumi Group has established a hurdle rate of 8% for investment decisions, 2% higher than the estimated cost of capital of 6%. We are working to improve capital efficiency by appropriately implementing financial strategy, which involves identifying capital cost for each business. In backing its efforts to achieve net sales of 2.5 trillion yen and operating income of 250 billion yen, the Company enlists as benchmarks not only return on equity (ROE) but also return on invested capital (ROIC), which is used as an indicator of profitability for each business. The Company conducts R&D, M&As, and business withdrawal by checking whether or not the target profitability exceeds its capital cost and furthermore verifying current status and outlook of individual businesses.

Our approach to increasing profitability of individual businesses has involved improving profit margins and reducing invested capital enlisting a reverse ROIC tree approach. By enhancing profitability of each business portfolio, we strive to optimize invested capital on a Company-wide basis. As a result of working on profitability improvement under this policy, ROIC for the fiscal year ended March 2023 came to 9.5%.

Going forward, we will seek to draw up business strategies and engage in business operations in alignment with initiatives for achieving sustainable growth and increasing corporate value over the medium to long term. In our efforts to increase corporate value, we will engage in risk management practices for reducing capital cost, and implement financial strategy which helps to enhance the competitive strengths of our products. Moreover, in seeking to ensure an optimum business portfolio, we hold management meetings twice per year to discuss business continuity of those businesses that fall short of the hurdle rate.

Business portfolio strategy

Focusing on growth of net sales and ROIC by business segment, we view the current state and the potential of the Company's business portfolio as indicated below. With regard to invested capital, we seek to optimize management resources in the fields of A to D defined in the figure below. To do this we plan to implement capital expenditures efficiently while utilizing grants and other funds. We will also focus on controlling inventories and other assets on a business segment basis in order to maintain working capital within an appropriate range.

Precision Technologies (PT; former Machined Components)

In Precision Technologies (PT), we expect an increase in net sales due to various factors including recovery of the data center market, shift to EVs and a shift to high functionality in the automobile market, and increasing demand for aircraft applications. In addition, we anticipate improvement in return on invested capital (ROIC) due to higher profits associated with the increase in sales. We aim for PT to achieve further expansion as a core business of the Company going forward.

Motor, Lighting & Sensing (MLS; former Electronic Devices and Components)

In Motor, Lighting & Sensing (MLS), we expect significant increase amidst the likelihood of further growth in motors centered on automotive use and expansion of applications particularly with respect to automotive backlights. We will enhance profitability centered on global niche top products. We will also expand MLS to serve as a pillar for company-wide earnings surpassing that of the target growth rate and hurdle rate.

Semiconductors & Electronics (SE; former MITSUMI Business)

In Semiconductors & Electronics (SE), we seek to strengthen the Eight Spears through expansion of business including that of semiconductors and the connector business that had been subject to business integration. Although at this point in time we envision a slowdown in the rate of net sales growth in optical devices and mechanical components, which have contributed to sales gains thus far, we will prompt a return to a growth trajectory in part by tapping into new products. We will improve profitability by rigorously cutting costs and increasing productivity.

Access Solutions (AS; former U-Shin Business)

Access Solutions (AS) has long encountered challenges with profitability, but has achieved certain results in terms of improving profitability as a consequence of focusing on PMI in the U-Shin business and proceeding with structural reforms in the European business. We will strive to increase sales and profitability by making the most of our favorable position as a Tier-1 business, including that of the newly integrated Minebea AccessSolutions.

Progress of Green Bond Framework

In November 2022, the Company issued its first series of green bonds to provide proceeds for production of high-quality bearings that contribute to greater power savings and groundbreaking precision, research and development, and procurement of decarbonized power sources. The Company will achieve its environmental targets by taking on the challenge of carbon neutrality and promoting MMI Beyond Zero. Going forward, we will continue to further promote initiatives to realize a sustainable global environment.

Risk management

Due to such factors as the shift towards a decarbonized society and heightened geopolitical risk, the business environment in which the Company operates is changing at dizzying speed on a day-to-day basis. In order to respond to such changes quickly and appropriately, we must strengthen our "defensive" approach to risk management in addition to taking an "aggressive" approach to maximizing profit.

The Representative Director, Chairman CEO of MinebeaMitsumi is the chief risk management officer and makes important decisions regarding risk management at the Risk Management Committee. It is also the role of the committee to assume specific risks and action plans for such risks and conduct continuous monitoring of the situation. As the CFO, I am focused on recognizing and forecasting our business environment, analyzing the impact of individual events on our business and performance, examining the likelihood of occurrence, urgency and impact of risks and opportunities, and formulating strategies and measures. I also execute those strategies and measures in a concrete and steady manner.

BCP constitutes one of the urgent issues facing the MinebeaMitsumi Group. This particularly includes initiatives for mitigating water risk. As such, we identify sites subject to substantial water-related risk, such as that involving flooding or drought, and then focus accordingly on developing and strengthening disaster prevention manuals and BCPs.

Furthermore, we address the significant challenge of establishing systems for deterring and preventing cyberattacks against companies.

We stringently reinforce such systems for deterring and preventing cyberattacks, which entails establishing a company-wide security task force encompassing our overseas operations, providing information security training to employees, and strategically augmenting our security systems.

In addition, in order to respond promptly to the strengthening of economic sanctions and export control regulation in various countries, and to take a more strategic approach to expanding the business, we have drawn up internal regulations regarding economic security, and established a system for management of economic security risk.

FAQ 1: What is your view on results for the fiscal year ending March 2024?

We anticipate record-high earnings on an operational basis excluding special factors in terms of a full-year results forecast for net sales of 1.45 trillion yen and operating income of 95 billion yen. This takes into account prevailing circumstances in terms of this fiscal year's macroeconomic trends and uncertainty regarding the prospect of data center recovery. In Precision Technologies, we expect to see recovery in the automotive and aircraft markets in the second half, offset by uncertainties regarding the prospect of recovery in the data center market. In Motor, Lighting & Sensing, growth in motors prompted by recovery in the automotive market will significantly contribute to earnings. In Semiconductors & Electronics, strong performance in optical devices and analog semiconductors will offset a decline in mechanical component revenue. In Access Solutions, we are aiming to achieve positive outcomes from business integration with growth in sales and profit accompanying market recovery.