2020

May 8, 2020

MINEBEA MITSUMI Inc.

Notice Regarding Introduction of Performance-Linked Stock Remuneration Plan for Directors

MinebeaMitsumi Inc. (the "Company") hereby announces that a resolution was made at a meeting of the Board of Directors held today to introduce a performance-linked stock remuneration plan (hereinafter the "Plan") using a trust for directors (excluding outside directors; hereinafter the same) of the Company and to submit the proposal at the 74th Ordinary General Meeting of Shareholders to be held on June 26, 2020 (the "General Meeting of Shareholders). The detail of the Plan is as follows.

1. Introduction of the Plan

The remuneration for Directors currently consists of the "basic remuneration", "performance-linked cash remuneration" and "Stock options". Subject to approval for the introduction of the Plan by the General Meeting of Shareholders, the Company shall stop issuing new "Stock options" and introduce a performance-linked stock remuneration plan for Directors.

The purpose of the Plan is to motivate Directors to contribute more to enhancing the medium- to long-term business performance of the Company and its corporate value, through further clarifying linkage between remuneration for Directors and the Company's business performance as well as to share the profits and risks of stock price fluctuations with shareholders.

After the introduction of the Plan, the remuneration for Directors shall consist of the"basic remuneration", "performance-linked cash remuneration" and "performance-linked stock remuneration".

2. Outline of the Plan

(1) Structure of the Plan

The Plan is a stock-based remuneration plan, in which a trust established and funded with money by the Company (hereinafter the "Trust") shall acquire shares of the Company, and the number of such shares equivalent to points granted to each Director shall be delivered to the Director through the Trust.

Under the Plan, the Company shares shall be delivered to Directors in service in a period of three years between the fiscal year ending 31 March, 2021 and the fiscal year ending 31 March, 2023 (hereinafter the "Applicable Period").

Such shares shall be delivered to each Director at the time of his/her retirement from office, in principle.

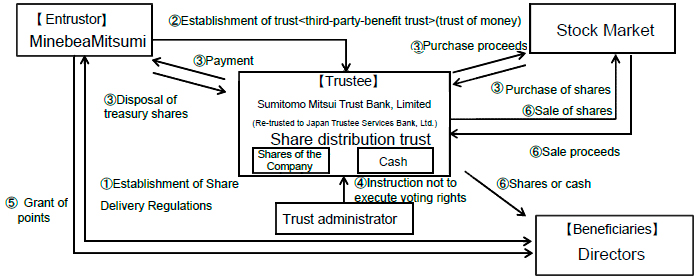

Outline of the structure of the Plan

- ① The Company shall establish the Share Delivery Regulations for Directors.

- ② The Company shall establish a share distribution trust (third-party-benefit trust) for Directors as beneficiaries (the "Trust"). When doing so, the Company shall entrust such amount of money corresponding to the funds for the acquisition of shares to trustee (provided that the entrusted amount should be up to the amount approved by the General Meeting of Shareholders).

- ③ The trustee shall collectively acquire (either through the disposition of treasury stock or through stock exchanges (including after-hours trading)) the number of the Company's shares that are expected to be delivered to the beneficiaries in future.

- ④ The Company shall appoint a trust administrator (to be limited to be a party independent of the Company or any directors and corporate auditors of the Company) who is responsible throughout the trust period for protecting the interests of the beneficiaries who are covered by the Share Delivery Regulations and supervising the trustee. Throughout the trust period, the trust administrator shall give instructions not to exercise any voting rights associated with the shares of the Company held within the Trust.

- ⑤ Pursuant to the Share Delivery Regulations, the Company shall grant points to the eligible Directors.

- ⑥ The Directors fulfilling requirements prescribe in the Share Delivery Regulation and the trust agreement related to the Trust will receive, as beneficiaries of the Trust, a delivery of shares of the Company corresponding to the accumulated number of points from the trustee. In certain specific cases set forth in advance in the Share Delivery Regulations and the Trust Agreement, the trustee will sell part of the shares to be delivered in the stock market and deliver cash.

It is intended that any of the Company's shares remaining as residual Trust assets at the time of termination of the Trust shall be retired based on the resolution of the Board of Directors after the Company acquires all such shares gratis.

It is intended that any money remaining as residual Trust assets at the time of termination of the Trust shall be donated to a specified public interest promotion corporation in which the Company and the Company's directors have no interest as stipulated in advance in the Share Delivery Regulations and the trust agreement for the Trust.

Sumitomo Mitsui Trust Bank Limited. , the trustee in the Plan, will entrust its management of trust assets (re-trust) to Japan Trusty Services Bank, Ltd.

(2) Establishment of the Trust

The Company shall establish the Trust by providing a fund necessary for the Trust to acquire, in certain period in advance, the number of shares of the Company reasonably estimated to be needed for the delivery in accordance with (6) below, subject to the approval on the introduction of the Plan at the Shareholder Meeting. The Trust shall, as described in (5) below, acquire shares of the Company by using the funds contributed by the Company.

Mitsui Sumitomo Trust Bank Limited. , the beneficiary in the Plan, entrusted its management of trust assets (re-trust) to Japan Trusty Services, Ltd.

(3) Trust period

The trust period is three years from July 2020 (scheduled) to July 2023 (scheduled). Provided, however, the trust period may be extended as describe in (4) below.

(4) Maximum amount of money in trust contributed to the Trust by the Company that are used for acquiring shares of the Company

During the Applicable Period, the Company shall establish the Trust for the benefit of Directors who meet certain beneficiary requirements, by contributing, during the Applicable Period, an amount not exceeding 300 million yen, as funds necessary for the Trust to acquire shares of the Company to be delivered to Directors under the Plan, as part of the remuneration for Directors in service during the period. The Trust shall acquire shares of the Company using the money entrusted by the Company, either in the stock market (including off-floor trade) or from the Company in the form of purchase of its treasury shares that are disposed of.

Note: The monetary amount to be actually entrusted to the Trust by the Company shall be the amount including the estimated necessary expenses such as trust fees and compensation for the Trust administrator, etc. on top of the aforementioned funds for acquiring shares of the Company.

The Applicable Period may, at its expiry, be extended for the maximum of another five fiscal years by resolution of the Board of Directors of the Company (including the case of effectively extending the trust period, by transferring the trust assets of the Trust to another trust established by the Company for the identical purpose; hereinafter the same) and extend the trust period to effect renewal of the Plan. In such instance, the Company shall additionally contribute an amount not exceeding 100 million yen into the Trust for each extended fiscal year of the Applicable Period, as the additional funds for acquiring shares of the Company necessary for the purpose of delivery to Directors under the Plan. In this case, the grant of points as describe in (6) below, as well as the delivery of shares of the Company shall continue during the extended period.

However, even in the case where the Applicable Period is not extended and the Plan is not continued as described above, if there are Directors who already received the granted points at the expiry of the trust period, but have not yet retired from office, the Company may extend the trust period of the Trust until such Directors retire from office and the associated delivery of shares of the Company is completed.

(5) Procedure for the Trust to acquire shares of the Company

Initial acquisition of shares of the Company by the Trust is scheduled to be accomplished through either purchase in the stock market, or purchase from the Company in the form of purchase of its treasury shares that are disposed of, within the maximum amount of the share acquisition funds as described in (4) above, and the detail of the procedure for such acquisition shall be disclosed based on the resolution thereon of the Board of Directors of the Company following the approval thereon at the Shareholder Meeting.

If the number of shares of the Company held in the Trust may, in the trust period, fall short of the number of shares that matches the number of points to be granted to Directors during the trust period, due to the reasons including an increase in the number of Directors, the Company may entrust additional money to the Trust, within the maximum money in trust as approved at the Shareholder Meeting as described in (4) above, thereby additionally acquiring shares of the Company.

(6) Method for calculating shares of the Company to be granted to Directors and maximum amount

- ① Method for granting points to Directors

The Company shall, pursuant to the Share Delivery Regulations established by its Board of Directors, grant to each Director the number of points calculated in accordance with criteria such as contribution to performance target etc. at the date when the Company defines during the trust period.

However, the aggregate number of points to be granted to Directors by the Company in a fiscal year shall not exceed 100,000. - ② Delivery of shares of the Company equivalent to granted points

Each Director shall receive the shares of the Company equivalent to points granted as described in ① above, and follow the procedure described in ③.

1 point shall be calculated as 1 share of the Company which may, in the event of circumstances that can reasonably justify adjustment to the number of shares of the Company to be delivered, such as share split or share consolidation of shares of the Company, be subject to such reasonable adjustment according to the ratio of such share split or share consolidation or other circumstances. - ③ Delivery of shares of the Company to Directors

Delivery of shares of the Company to each Director described in ② above, shall be done by the Trust, subject to the completion of the predetermined beneficiary verification procedures by each Director at the time of his/her retirement from office.

Provided, however, that certain portion of the shares of the Company to be delivered may be sold/realized in the Trust first for the purpose of withholding tax payment funds such as withholding income tax and delivered in the form of cash in lieu of shares of the Company, and that in the event of realization of shares of the Company held in the Trust due to the settlement following the circumstances such as subscription of a tender offer for shares of the Company held in the Trust, the Trust may also effect the delivery in the form of cash in lieu of shares of the Company.

(7) Exercise of voting rights

Voting rights associated with the shares of the Company held in the Trust shall, under the instruction of the trust administrator independent of the Company or any directors of the Company, not be exercised at all, in an effort to ensure neutrality towards the management of the Company, in the exercise of voting rights associated with the shares of the Company held in the Trust.

(8) Handling of dividends

Dividends of the shares of the Company held in the Trust shall be received by the Trust, and used for acquiring shares of the Company as well as for the trust fees to be paid to the trustee with respect to the Trust.

(9) Procedure of shares of the Company and cash at the termination of the trust period

Of the residual assets held in the Trust at the termination of the trust period, shares of the Company shall wholly be acquired without consideration by the Company and then cancelled by resolution of the Board of Directors, while certain amount of cash shall be donated to specific public interest promotion corporations with no interest with directors, subject to prior arrangement of relevant provisions in the Share Delivery Regulations as well as in the trust agreement.

| Entrustor | The Company |

|---|---|

| Trustee | Sumitomo Mitsui Trust Bank, Limited (Re-trusted to Japan Trustee Services Bank, Ltd.) |

| Beneficiaries | Directors who meet the requirements |

| Trust administrator | To be selected from third parties having no conflict of interests with the Company and its Directors |

| Exercise of voting rights | No voting rights will be exercised for the shares in the Trust during the Trust period |

| Type of trust | Money trust other than cash trusts (third-party-benefit trust) |

| Date of conclusion of the Trust Agreement | July, 2020 (scheduled) |

| Trust Period | July, 2020 – July, 2023 (scheduled) |

| Objective of the Trust | To deliver the Company shares to Beneficiaries based on the Share Delivery Regulations |

| Company Name: | MINEBEA MITSUMI Inc. |

| Representative: | Yoshihisa Kainuma Representative Director, CEO & COO (Code No. 6479, TSE Div. No. 1) |

| Contact: | Motohide Ishigami Officer in charge of Personnel & General Affairs Div. Executive Officer |

| Phone: | +81-(0)3-6758-6712 |

Product information, contact and other context are subject to change without prior notice.